If you haven’t been stuck under a giant rock, you probably heard that Apple recently announced and made available its own Credit Card. The Apple Card as its being touted is a Credit Card, backed by first time Credit Card issuer - Goldman Sachs. Goldman Sachs is a household name in the financial world and was one of the huge offenders who caused the 2008 Housing Crisis which led to the Great Recession, but thats a rant for another post.

Prerequisites

Apart from the usual - creditworthiness, income, age, residency and other requirements - the Apple Card has one additional gotcha.

You must have an iPhone (or at least an iPad) to signup for the card. There is no workaround for this, as far as I can tell.

The Good

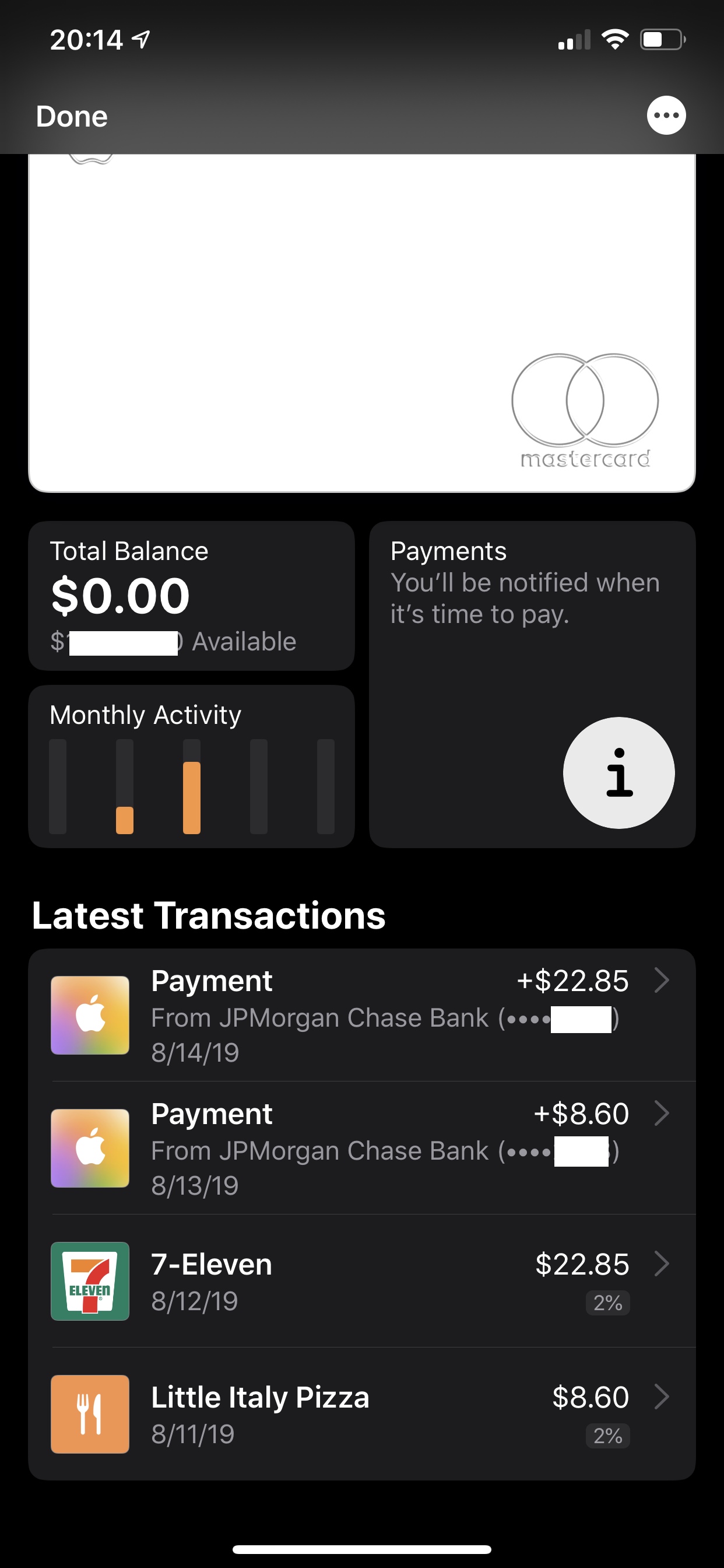

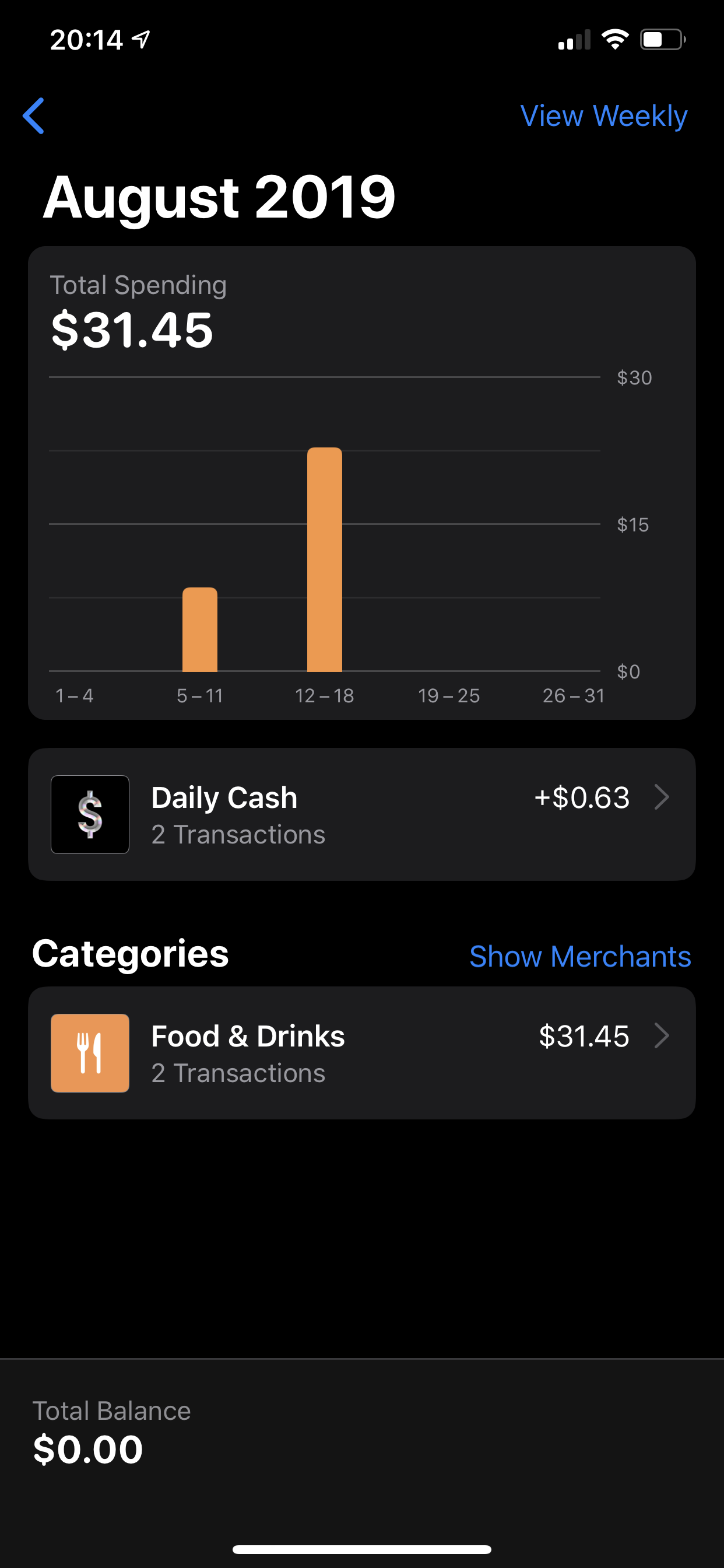

Financial Management Interface

If you are on an iPhone, there is no denying that the interface to manage the card and track your spending is best in class. No other bank’s app comes anywhere close to it. The interface to look at transactions, spend summary and payments calculation - is a work of art in its own right. Add to the fact that the app is native and already installed on all iPhones, makes it a breeze to use.

Its Free

I mean, there’s no annual fee, or any other fees associated with the card - no annual fees, no late payment fee, no foreign transaction fee, no over limit fees etc - thats a solid baseline that every bank should adopt. This is all indeed a good thing.

The Apple Card is also backed by MasterCard’s World Elite network. This is usually only designated to premium cards with an Annual Fee. However, a lot of the nicer perks do not apply to the Apple Card.

It is a Beautiful Card

This doesn’t help with your financial goals of getting a Credit Card, but damn, the Apple Card is one beautiful piece of metal! It is clean, simple, solid, feels good in the hand and screams premium!

The Bad

Platform (iOS) Lock In

In plain and simple words, as it stands today, you must have an iPhone or at least an iPad in order to use the card and manage it. In the absense of a web interface (like every other bank has), Apple does point out that you can call a number to make payments etc. Thats nice of them, but who wants to do that?

Opportunity Cost

This one is huge. Basically, there are plenty of other cards out there, even free ones, that do better than Apple’s Cash back.

Apple Card’s Cash back is bucketed into three categories

- Apple Product Purchases (from Apple): 3%

- Apple Pay Purchases (at any merchant): 2%

- Purchases with physical card (anywhere): 1%

On the surface, these are okay, but as mentioned, many other cards do it better. While you aren’t losing money out of pocket - other cards can earn you better rewards!! Be sure to checkout the section below - Alternatives.

Lack of Web Interface

The only way, and I repeat, the only way to manage your card, make payments and in general interact with your account is via your iPhone (or iPad). Your only option is to call Apple, using a number that isn’t even imprinted on the back of your physical card (like most others).

Seriously, this is huge! Make sure you carry a small piece of paper with the customer service number :) On the bright side, when you buy a new iPhone to replace the one you lost, you will be earning 3% back!

In Conclusion

The Apple Card has a slick, best in class mobile interface, feels great in the hands and offers average rewards. The physical card is more of a fashion statement than something that gives you great financial rewards - but then again, isn’t that true of many Apple products?

The ecosystem (iPhone) lock in is real. Do consider: do you want to consider switching credit cards if you want to an Android Device?

Alternatives

Yes there are better alternatives. And all of these come with the convenience of a mobile app - that probably isn’t as slick as Apple’s - but gets the job done. Also, all of these have regular web interfaces!

These are cards that I personally carry and recommend. I have no affiliation with the banks concerned.

Raw Cash Back Cards

Discover IT has no annual fee and its cash back has rolling categories of 5%. It also carries the same 1% baseline on non 5% categories. And it comes with a $50 signup bonus.

- Cash Back: 5% (10% in first year) rolling categories and 1% (2% in first year) baseline.

- Sign Up Bonus: $50

- Annual Fee: NONE

- Link: http://bit.ly/DiscoverITCreditCard

Chase Freedom mostly mimic’s Discover’s offering.

- Cash Back: 5% rolling categories and 1% baseline.

- Sign Up Bonus: $150

- Annual Fee: NONE

- Link: http://bit.ly/ChaseFreedomCreditCard

Travel Focussed

If you are a little travel focussed, you can make your rewards go further.

Chase Saphire Preferred is a great starter travel card. While it does come with a $95 annual fee, your signup bonus is 60,000 points that translates to $750 when spent on travel!

- Sign Up Bonus: 60,000 points ($750 when spent on travel)

- Annual Fee: $95

- Points: 2x on travel and food, 1x on everything else

- Link: http://bit.ly/ChaseSaphirePreferredCard

American Express Gold Card is my final recommendation. While the $250 annual fee sounds steep - you get an annual credit of $120 towards food (Seamless, Shake Shack etc) and $100 towards airline fees - which about bring you close to breaking even on the fee. Also, it comes with a 35,000 point sign up bonus.

- Sign Up Bonus: 35,000 ($350)

- Annual Fee: $250

- Points: 4x at restaurants and supermarkets (!!!), 3x on flights

- Annual Bonus: $100 towards airline fees

- Monthly Bonus: $10 towards Seamless, GrubHub, Shake Shack etc.

- Link: http://bit.ly/AmExGoldCard